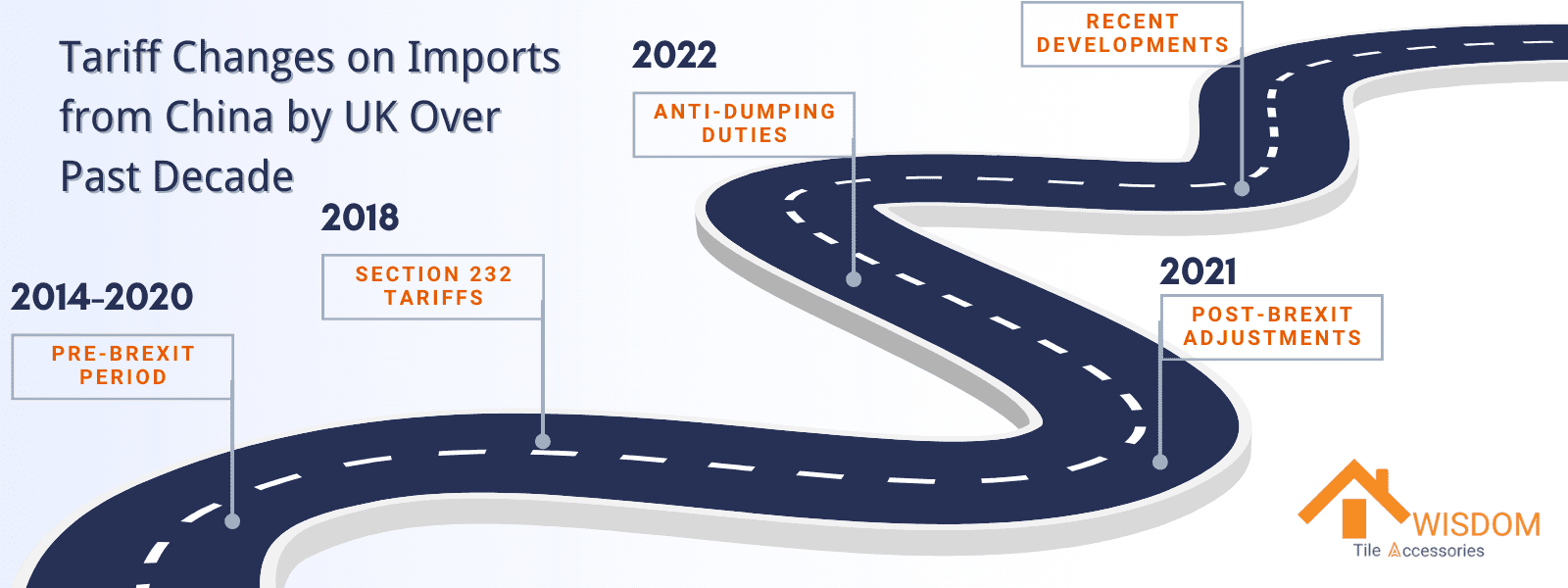

As the UK navigates the post-Brexit trading landscape, import tariffs on goods from China, including critical building materials like aluminum, have undergone significant changes, impacting importers across the nation.

This article takes an in-depth look at the evolution of these tariff adjustments from 2014 to date, and provides effective solutions for how UK businesses can adapt to these changes.

Pre-Brexit Period (2014 - 2020)

EU Common External Tariff (CET):

During the pre-Brexit period, the United Kingdom was a member of the European Union and adhered to the EU's Common External Tariff (CET). This tariff regime was applied uniformly across all member states for imports from non-EU countries, including China. Consequently, tariffs imposed on Chinese goods imported into the UK were aligned with broader EU policies.

In 2014, statistical data reveals that the simple average tariff rate on all products imported into the UK was approximately 2.90%, with a trade-weighted average tariff rate slightly lower at 2.38%. These figures underscore the UK's integration within the EU's tariff structure, impacting the costs and availability of Chinese goods in the British market.

Changes in EU Tariff Policies:

Between 2013 and 2015, significant adjustments were made to the EU's tariff policies concerning imports from China. One of the pivotal changes was the removal of China from the General System of Preferences (GSP). The GSP is designed to facilitate economic development in emerging economies by offering preferential tariff rates on their exports to the EU.

However, as China's economy grew, it was deemed capable of competing under standard international trade conditions, leading to its exclusion from the GSP scheme. This exclusion marked a shift to higher Most Favoured Nation (MFN) duties on Chinese goods, reflecting a tightening of conditions under which Chinese products entered the EU, and by extension, the UK market. This policy adjustment was indicative of the EU's strategic recalibration in response to China's evolving economic status and its implications for global trade dynamics.

Section 232 Tariffs on Steel and Aluminum (2018)

Table 1: Tariff Structures in 2018

Tariff Range | UK Exports to China | China Exports to UK* |

|---|---|---|

0% | 25.3% | 39.0% |

>0 - 5% | 20.5% | 37.3% |

>5 - 10% | 18.3% | 12.3% |

>10 - 20% | 3.6% | 11.0% |

>20% | 32.3% | 0.0% |

*Note: China reduced some MFN tariff rates in 2018, so actual tariffs may be lower than shown.

Introduction of Section 232 Tariffs:

In 2018, the global trade landscape experienced a significant shift when the United States implemented additional tariffs on imports of steel and aluminum. Effective June 1, 2018, the U.S. government imposed a 25% tariff on steel and a 10% tariff on aluminum imports from almost all countries, citing national security concerns under Section 232 of the Trade Expansion Act of 1962. Although these measures were specifically enacted by the U.S., their impact reverberated across the global trading system, including in the United Kingdom.

The introduction of these tariffs by the U.S. marked a pivotal moment in international trade relations, influencing not only direct trade between the U.S. and China but also affecting how other countries, including the UK, navigated their import strategies. The ripple effects of these tariffs were felt in various sectors, impacting commodity prices and trade policies worldwide.

For the UK, still a member of the EU at this time, these U.S. policies necessitated a reassessment of its own trade practices and tariff structures in response to the altered global market dynamics and the potential for trade diversion effects. This scenario underscores the interconnected nature of global trade and the wide-reaching implications of national policy decisions in one major economy on others.

Post-Brexit Adjustments (2021)

Table 2: Top UK Goods Trade with China in 2021 (£ billion)

Imports | Value | Exports | Value |

|---|---|---|---|

Machinery & Transport Equipment | 27.5 | Machinery & Transport Equipment | 7.7 |

Miscellaneous Manufactured Articles | 19.2 | Miscellaneous Manufactured Articles | 2.9 |

Manufactured Goods | 8.4 | Manufactured Goods | 2.3 |

UK Global Tariff (UKGT):

The commencement of the UK Global Tariff (UKGT) on January 1, 2021, marked a significant evolution in the United Kingdom's trade policy following its departure from the European Union. This new tariff regime was instituted as a direct replacement for the EU's Common External Tariff (CET) and now governs the duties applied to all goods imported into the UK, except where specific trade agreements, exceptions, or provisions under the Developing Countries Trading Scheme (DCTS) apply.

The UKGT was designed with a dual focus: simplification and competitive advantage. It sought to streamline the previously complex tariff structure and lower the tariff rates on numerous products. This strategic adjustment was aimed at enhancing the competitiveness of UK businesses by reducing import costs and facilitating smoother and more economical trade operations.

The UKGT not only reflects the UK's independent trade policy ambitions but also its approach to fostering a dynamic, open market that can efficiently integrate into the global economy post-Brexit. This reformative move plays a crucial role in redefining the UK's trade relationships worldwide and demonstrates a significant shift towards adapting its economic policies to better suit its national interests and the needs of its business community.

Table 3: Top UK Services Trade with China in 2021 (£ billion)

Imports | Value | Exports | Value |

|---|---|---|---|

Other Business Services | 1.1 | Travel | 2.8 |

Financial Services | 0.4 | Sea Transport | 1.0 |

Insurance Services | 0.3 | Financial Services | 0.9 |

Anti-Dumping Duties and Trade Disputes (2022)

Anti-Dumping Duties on Aluminum Radiators:

In response to the market challenges posed by the importation of unfairly priced goods, the UK took a decisive step in 2022 by imposing anti-dumping duties on aluminum radiators originating from China. These duties are levied in addition to the usual customs tariffs and are specifically designed to protect the domestic manufacturing sector. The imposition of these duties underscores the UK's commitment to ensuring fair competition and safeguarding its industries from the detrimental effects of dumping, which typically involves exporting goods at prices lower than their normal value in the domestic market of the exporter. This measure reflects a broader strategy to maintain the integrity of the UK market and support the stability of domestic industries by mitigating the impact of potentially disruptive import practices.

Resolution of U.S.-UK Steel and Aluminum Tariff Dispute:

On March 22, 2022, a significant development occurred in the arena of international trade relations between the UK and the US. The two nations reached a bilateral agreement that effectively resolved a lingering three-year dispute concerning tariffs on steel and aluminum. This accord established tariff-rate quotas (TRQs), which permit specified quantities of UK steel and aluminum to enter the US market duty-free. This arrangement was reciprocated by the UK with the suspension of its retaliatory tariffs on various US goods. The resolution of this dispute is a key milestone in reinforcing the trade relationship between the UK and the US, fostering a mutually beneficial economic environment and demonstrating a collaborative approach to resolving complex trade issues. This development not only stabilizes the market conditions for affected industries in both countries but also sets a precedent for how similar trade disputes might be amicably resolved in the future.

Recent Developments (2023-2024)

Trade and Investment Data:

The trade dynamics between the UK and China have experienced notable fluctuations as detailed in the latest data covering the period up to the end of Q4 2023. The UK's imports from China have been reported at £58.8 billion, marking a significant decrease of 20.0% compared to the previous year. This reduction in imports could be attributed to various factors, including changes in tariff policies, shifts in consumer demand, or broader economic conditions affecting trade volumes.

Similarly, UK exports to China during the same timeframe totaled £31.5 billion, also showing a decrease of 19.9% from the previous year. This decline in exports highlights challenges in market access, competitive factors, or perhaps geopolitical influences that might have affected trade relations.

Furthermore, the trade deficit between the UK and China was reported at £27.3 billion, which, while still substantial, represents an improvement from the £34.2 billion deficit recorded in the previous year. This reduction in the trade deficit could indicate a better balance in trade relations and might reflect the effectiveness of recent economic policies and trade agreements aimed at enhancing the UK's trade performance with China.

These figures underscore the ongoing complexity of the UK-China trade relationship and the significant impact of international trade policies and global economic trends on bilateral trade. They also highlight the need for continued strategic adjustments and negotiations to foster a more balanced and mutually beneficial economic relationship between the two nations.

How do UK Importers Deal with High Tariffs?

In the context of the evolving tariff landscape, particularly the adjustments that have been made to the UK's tariffs on imports from China over the past decade, a key question arises for many British importers: How can they effectively manage these high tariffs? This is a thorny issue for businesses that were used to importing goods from China, as they are now finding these tariffs affecting their business.

Amidst this challenging scenario, UK importers have various strategies to consider, one of which is exploring alternative markets and supply chains that are not subject to these high tariffs. For businesses importing building materials, and particularly aluminum products, the solution might lie in innovative supply chain adjustments.

Awisdom Tile Accessories, a global supplier and manufacturer of decorative building materials, presents a viable solution for importers looking to mitigate the impact of high tariffs. Our company has established a production facility in Vietnam, a strategic move that leverages the favorable trade agreements between Vietnam and the UK. By sourcing aluminum from our Vietnamese factory, UK importers can benefit from the absence of anti-dumping duties that typically apply to similar imports from China. This approach not only circumvents the financial burden of tariffs but also ensures a steady and reliable supply of high-quality aluminum products.

For more information, please refer to: How to Avoid Taxes When Importing Aluminum from China to UK

This guide offers comprehensive insights into optimizing your import strategy, ensuring that your business can continue to thrive without the heavy weight of tariff costs.