Anti-Dumping Duty Calculator

Anti-Dumping Duty Calculator, an online tool, provides a straightforward means to calculate anti-dumping duties, a crucial aspect of international trade regulation. Users can input the export price and normal value of goods, enabling the calculation of dumping margin, anti-dumping duty, and final price to the importer.

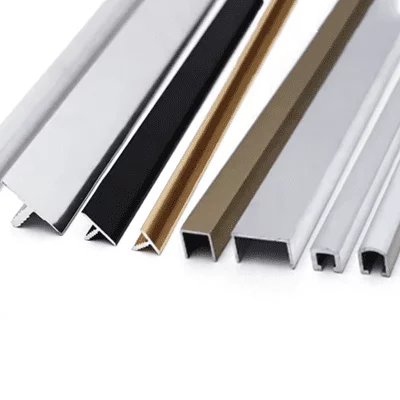

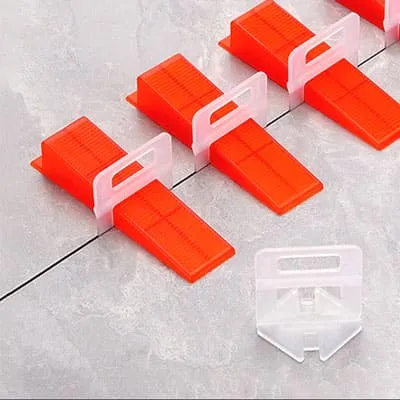

Designed specifically for construction engineers, dealers, wholesalers, and contractors across Europe, North America, and Australia, our calculator aims to simplify the complexities of international trading. We specialize in aluminum alloys and stainless steel, offering personalized anti-dumping solutions and duty-free distribution services by sea and air.

How to Use a Anti-Dumping Duty Calculator?

This calculator provides users with a simple means to understand and compute anti-dumping duties. Before delving into the calculations, it's essential to grasp the concept of anti-dumping and the significance of its parameters.

What is Anti-Dumping Duty

Anti-dumping refers to the imposition of additional duties on imported goods that are sold at prices lower than their normal values in the exporting country's domestic market. These measures aim to protect domestic industries from unfair competition and ensure a level playing field in international trade.

Input Parameters

a. Export Price (EP): This parameter represents the price at which the goods are sold for export to another country.

b. Normal Value (NV): The normal value denotes the price of the product in the exporting country's domestic market, typically adjusted for various factors such as taxes, market conditions, and production costs.

Output Parameters

a. Dumping Margin: The dumping margin indicates the extent to which the export price is lower than the normal value. It's calculated as a percentage using the formula: ((NV - EP) / NV) * 100.

b. Anti-Dumping Duty (ADD): This parameter represents the additional duty imposed on imported goods to counteract the effects of dumping. It's calculated as the maximum of zero or the difference between the normal value and export price.

c. Final Price to Importer: This is the total price paid by the importer, including the export price and the anti-dumping duty.

Calculation Formulas

$$ \text{Dumping Margin (%)} = \left( \frac{{\text{NV} - \text{EP}}}{{\text{NV}}} \right) \times 100 $$

$$ \text{Anti-Dumping Duty} = \max(0, \text{NV} - \text{EP}) $$

$$ \text{Final Price to Importer} = \text{EP} + \text{ADD} $$